If I were looking to buy, I'd pay some attention to the properties with the higher Rent/Sale ratio and determine if there was a mispricing issue. If the rents are credible, these properties could offer a good value buying opportunity.

If I were looking to rent, I'd look at properties at the lower end of the scale for good rental value. Of course there are a number of reasons that a high value property might rent at a relatively low rate. Three reasons that quickly come to mind: 1. a collapsing real estate market; 2. a property that has additional developable land, which adds sale value, but less rental value; and 3. property management expenses passed-on to tenant outside the rent rate.

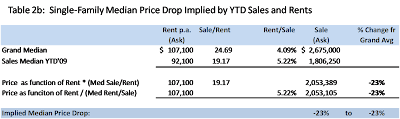

Greenwich single-family properties both for sale and rent: